oklahoma sales tax car purchase

If you need to refer to the OMVC law andor the Commissions Rules and Regulations you may also. Use our OkCARS - Sales and Excise Tax Estimator to help determine how much sales and excise tax you will pay on your new purchase.

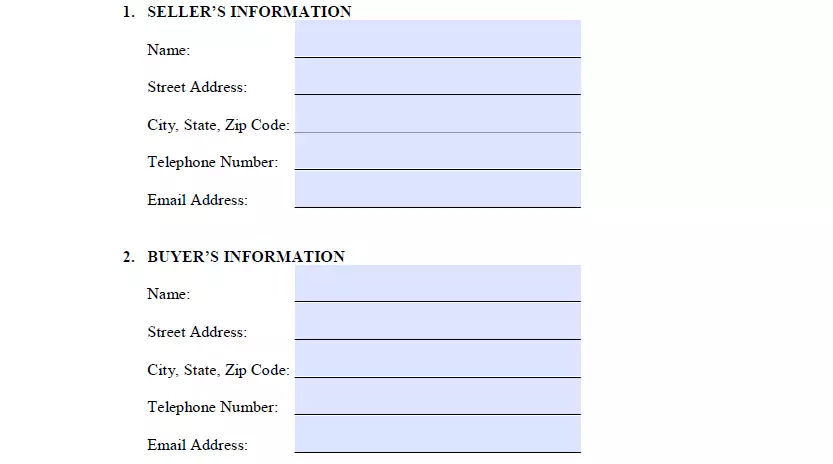

Free Oklahoma Vehicle Bill Of Sale Form Pdf Formspal

Consumers may file complaints with the Oklahoma Motor Vehicle Commission regarding New Motor Vehicle Dealers and their sales management or finance staff which are licensed by this Commission.

. 20 up to a value of 1500 plus 325 percent on the remainder value. Standard vehicle excise tax is assessed as follows. Only five states do not have statewide sales taxes.

The tax is depending on the purchase price. Used vehicles are taxed a flat fee of 20 on the first 1500 of the purchase price and the standard. 2000 on the 1st 150000 of value 325 of the remainder.

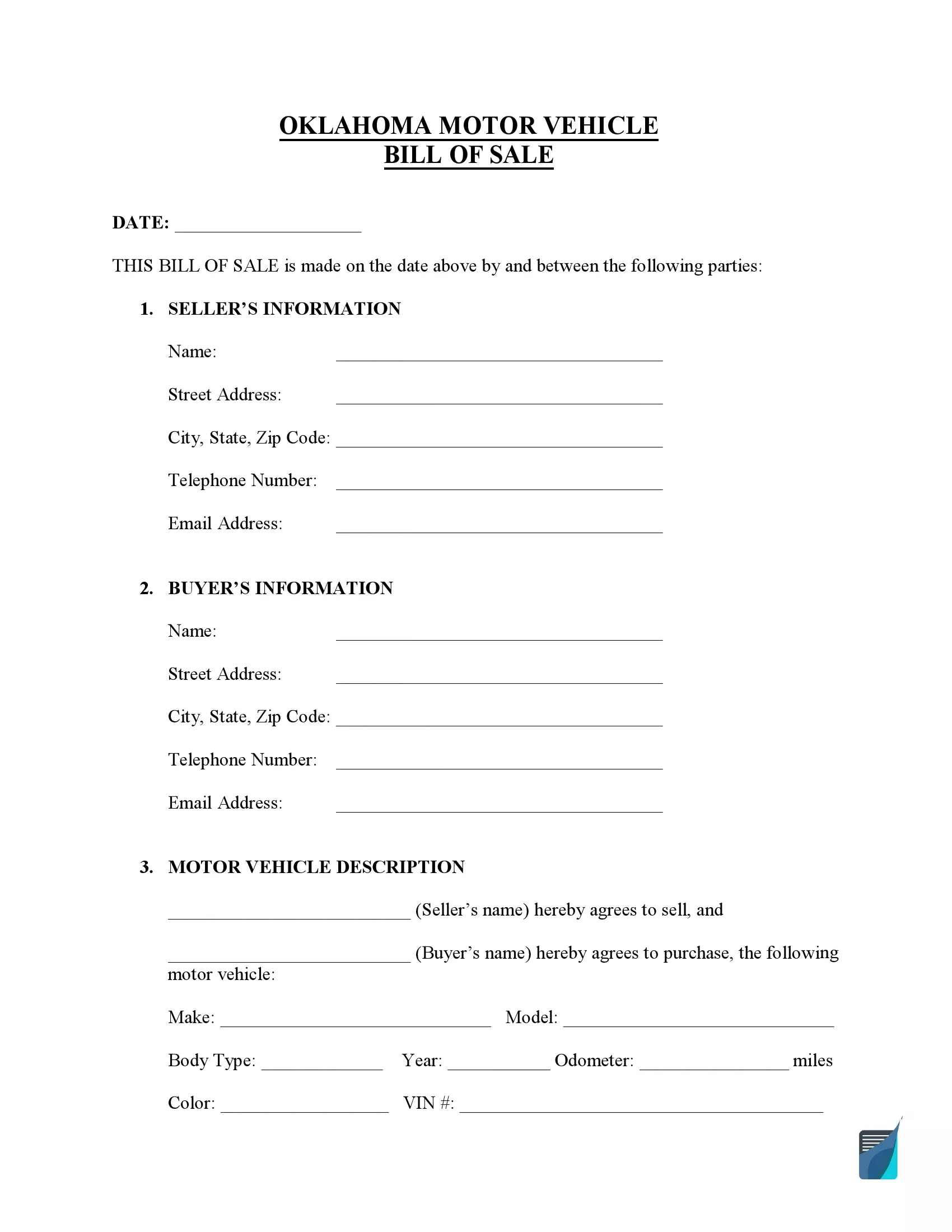

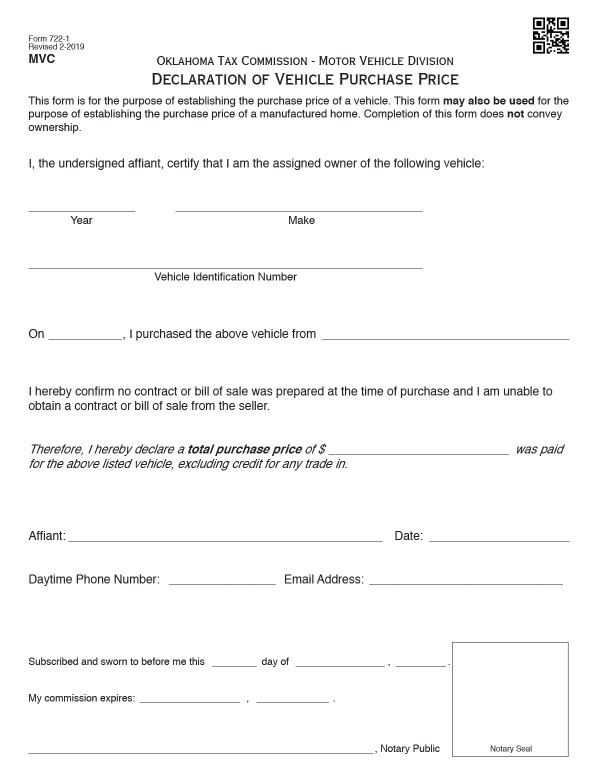

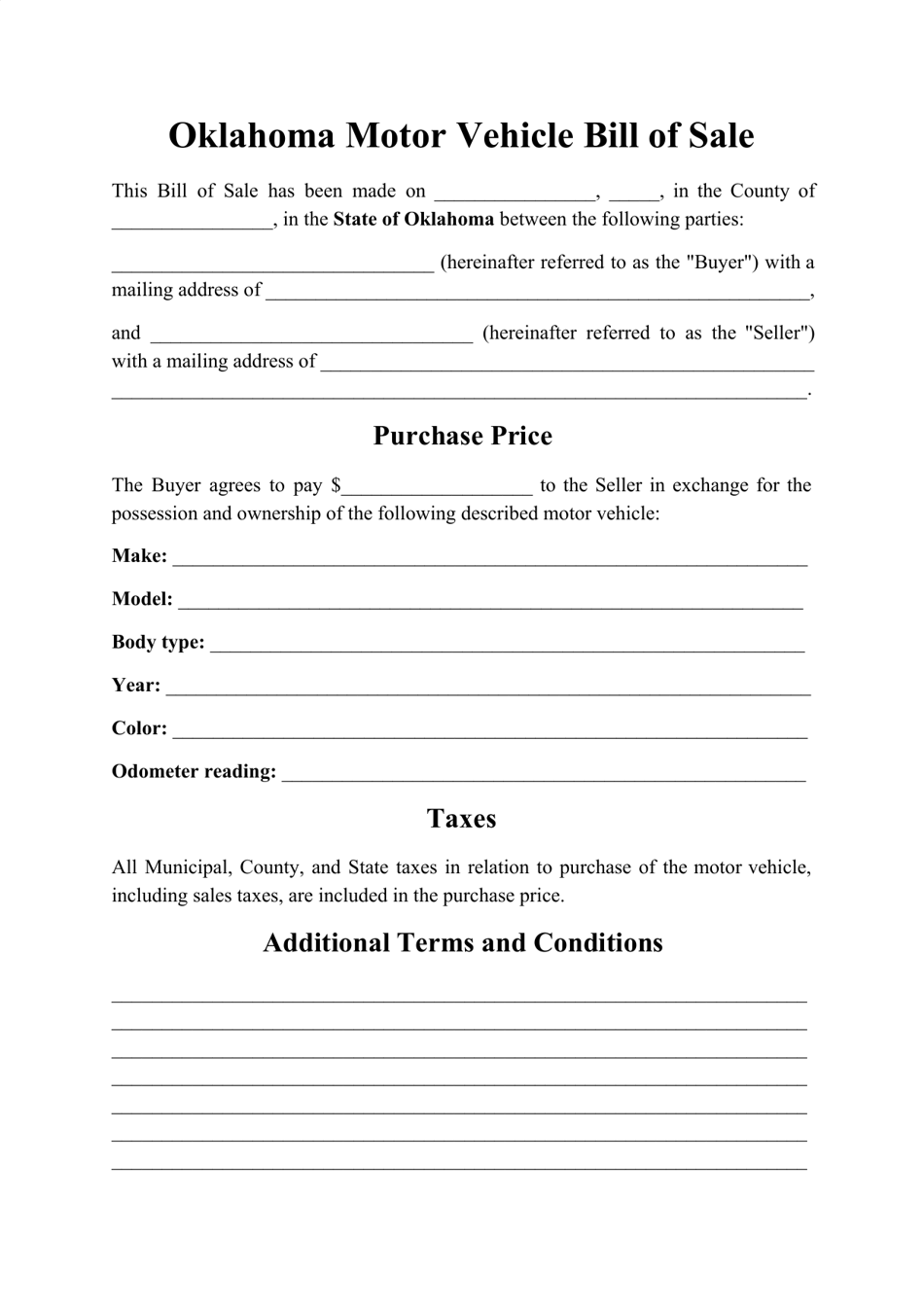

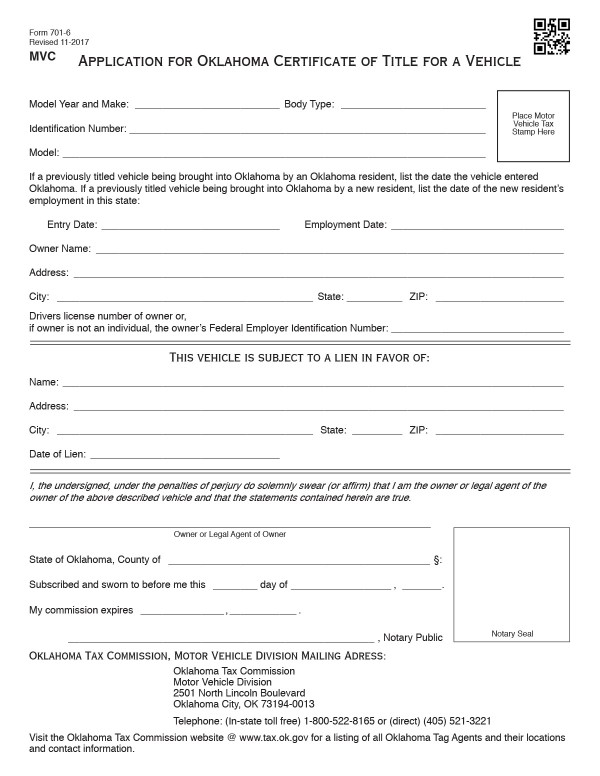

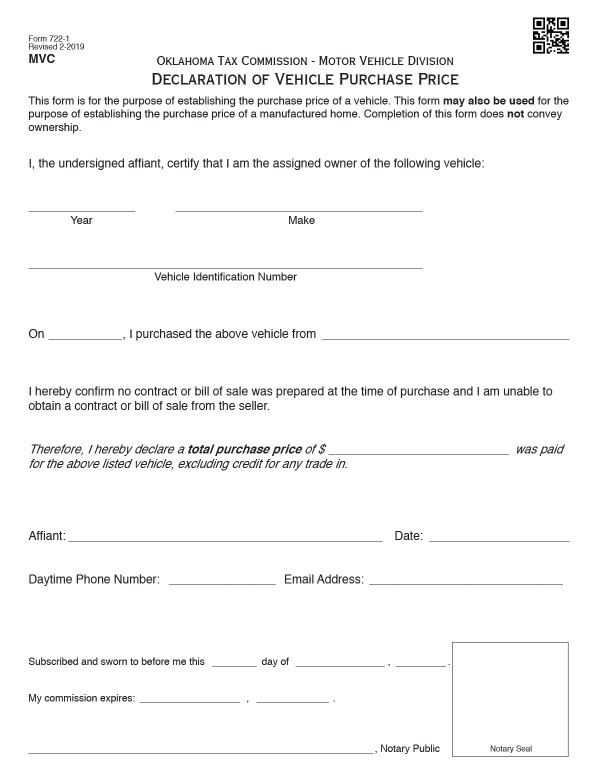

You must provide a purchase contract an Oklahoma bill of sale or a Declaration of Vehicle Purchase Price Form 722-1. This is the largest of Oklahomas selective sales taxes in terms of revenue generated. 125 sales tax and 325 excise tax for a total 45 tax rate.

The cost for the first 1500 dollars is a flat 20 dollar fee. Currently a 125 percent sales tax is applied to the purchase of a vehicle. Motor vehicle taxes in Oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth the value of the vehicles.

Proof of purchase price. 325 of the purchase price or taxable value if different Used Vehicle. Senate Bill 1619 authored by Sen.

Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle. Oklahoma excise tax provided they title and register in their state of residence. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

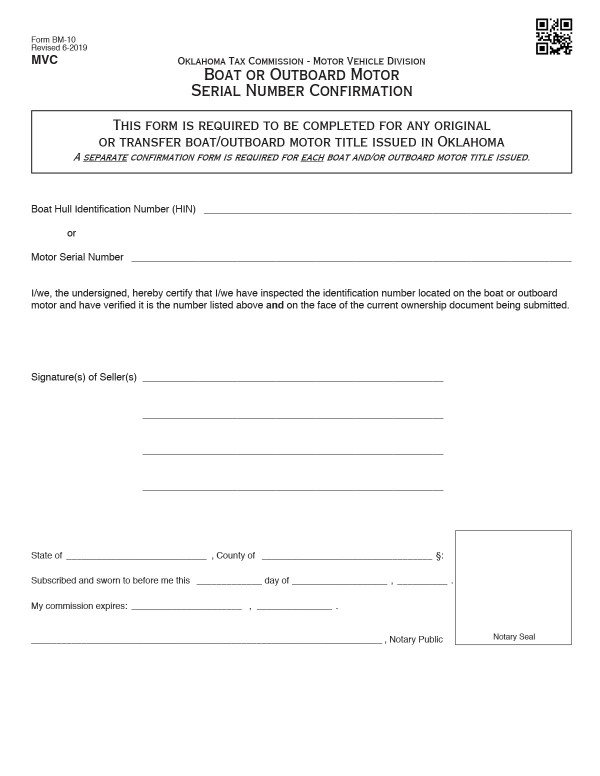

Vehicle inspections and maintenance. Most vehicles all terrain vehicles boats or outboard motors are assessed excise tax on the basis of their purchase price provided. As noted above.

OKLAHOMA CITY KFOR The Oklahoma Senate passed a measure Thursday to modify how vehicle sales tax is calculated. Until 2017 motor vehicles were fully exempt from the sales tax but under HB 2433 the exemption was partially lifted and motor vehicles became subject to a 125. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4241 on top of the state tax.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Duplicate Title in Oklahoma You can replace a missing Oklahoma car title by filling out the Application for Replacement Certificate of Title for VehicleBoatMotor Form 701-7 and mailing or. In addition to taxes car purchases in Oklahoma may be subject to other fees like. Oklahoma OK Sales Tax Rates by City The state sales tax rate in Oklahoma is 4500.

Please refer to the complaint form and instructions. Oklahoma charges two taxes for the purchase of new motor vehicles. State and local taxes that will apply to your purchase.

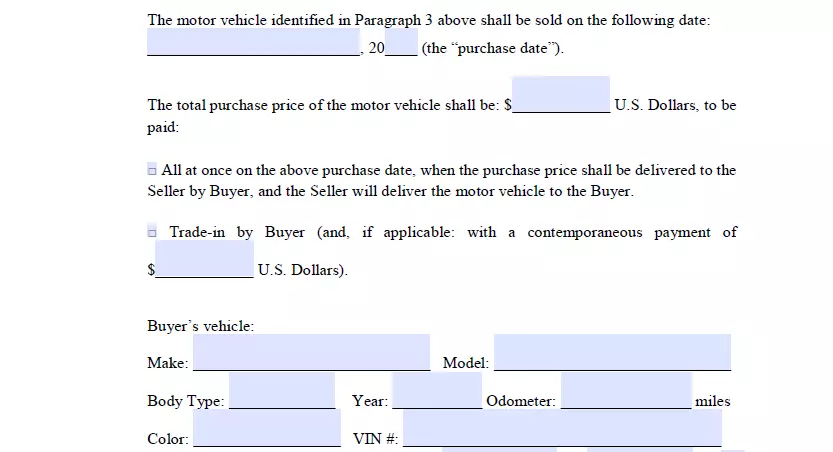

Oklahoma has a lower state sales tax than 885. Darcy Jech R-Kingfisher would modify this calculation so the sales tax would be based on the difference between the actual sales price of a vehicle and the value of a trade-in if applicable. Montana Alaska Delaware Oregon and New Hampshire.

A 125 percent sales tax is levied on a vehicles full price when a vehicle. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. The measure would allow those with a trade-in to have the trade-in allowance deducted from the.

When a vehicle is purchased under current law a sales tax of 125 percent is levied on the full price of the car. Excise tax on boats and outboard motors is based on the manufacturers original retail selling price of the unit. Vehicle tax or sales tax is based on the vehicles net purchase price.

The sales tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and. Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes. For more information about the total cost of purchasing a vehicle please contact the Oklahoma DMV.

Oklahoma Tax Commission vehicle registration and license plate fees. Unfortunately unless you register the car in the sales-tax-free state you will still have to pay the sales tax when you register. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Oklahoma local counties cities and special taxation districts. OKLAHOMA CITY The Oklahoma State Senate passed a bill to reinstate full sales tax exemptions on motor vehicles and trailers. With local taxes the total sales tax rate is between 4500 and 11500.

So if you used a 8 general sales tax rate for your state this would have to be the same sales tax rate for your vehicle purchase. How do you figure sales tax on a car in Oklahoma. The sales tax rate for the Sooner City is 45 however for most road vehicles there is a Motor Vehicles Excise Tax assessed at the time of sale or when the new Oklahoma car title is issued in the new owners name.

Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in the. The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11.

You are only allowed the major purchase additional sales tax amount if the sales rate you used for your general state sales tax rate is the same sales tax rate on your major purchase. Senate Majority Leader Kim David presented State Bill 593 on Tuesday.

Oklahoma Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft Bill Of Sale Template Bills Templates

Bills Of Sale In Oklahoma The Templates Facts You Need

Bills Of Sale In Oklahoma The Templates Facts You Need

How To Sell A Car In Oklahoma Documents Required And More

Oklahoma Vehicle Registration And Title Information Vincheck Info

A Complete Guide On Car Sales Tax By State Shift

Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

What S The Car Sales Tax In Each State Find The Best Car Price

Free Oklahoma Motor Vehicle Dmv Bill Of Sale Form Pdf

Free Oklahoma Bill Of Sale Form Pdf Template Legaltemplates

Free Oklahoma Vehicle Bill Of Sale Form Pdf Formspal

![]()

Free Oklahoma Motor Vehicle Bill Of Sale Form Pdf Word

Free Oklahoma Dps Motor Vehicle Bill Of Sale Form Pdf Word Doc

Bills Of Sale In Oklahoma The Templates Facts You Need

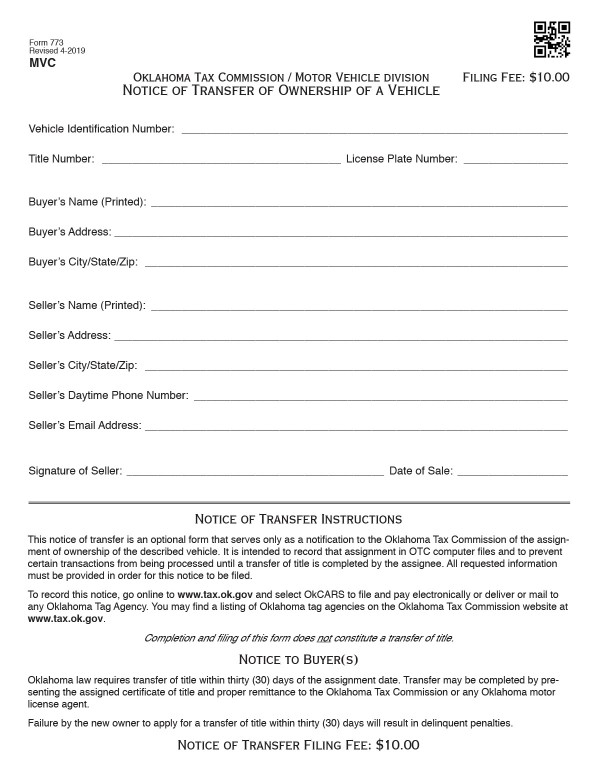

Oklahoma Title Transfer How To Sell A Car Quick At Fair Prices

Bills Of Sale In Oklahoma The Templates Facts You Need